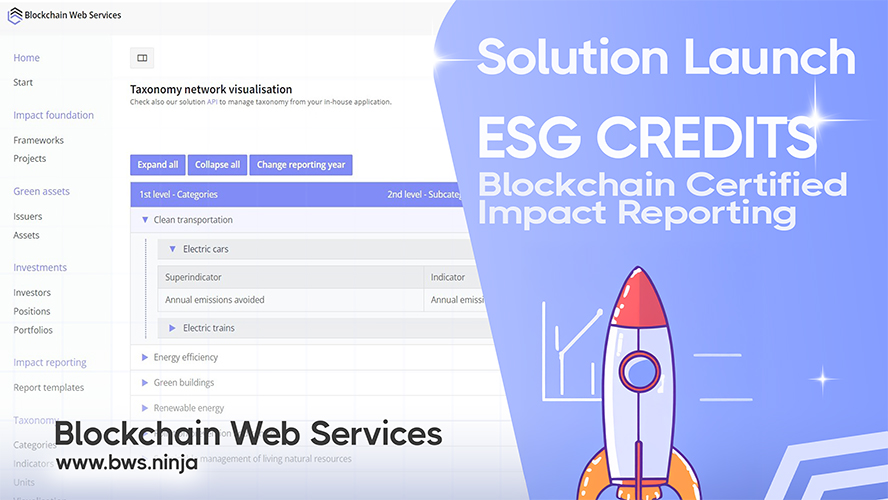

Automated ESG Framework Solution

The ESG Credits solution certifies impact and tokenizes sustainability projects using the BWS.ESG API. Organizations can mint, track, and prove green action with blockchain-backed verification that satisfies investor requirements.

This infrastructure specifically targets sustainability startups, NGOs, ESG fintechs, and carbon markets seeking standardized reporting capabilities. Strong inbound interest from ESG and corporate actors is already driving live demos as the market shifts toward blockchain-verified impact reporting.

Built around the ICMA framework, the solution balances structure with flexibility. It follows ICMA's established principles and logic while remaining deliberately adaptable to various green finance standards and regional requirements—ensuring organizations aren't locked into a single taxonomy as regulations evolve.

Investor-Grade Comparison and Analysis

Beyond certification, the issuer marketplace empowers investors, advisors, and analysts to visually compare green bond frameworks side-by-side. Using embedded charts and structured fact tables, users can assess ESG characteristics head-to-head and align investments with frameworks that match their specific criteria.

This comparison capability eliminates a critical friction point in green investing. Instead of wading through lengthy PDF documents, stakeholders can evaluate multiple frameworks simultaneously with standardized metrics and visual representations that make differences immediately apparent.

The result is a fundamental transformation in how investment decisions are made. ESG characteristics become instantly comparable, helping capital flow to projects with genuine impact while significantly reducing greenwashing risks through transparent, standardized disclosure.

Key Benefits and Advantages

ESG Credits delivers comprehensive infrastructure for green finance reporting and verification. By combining automation, standardization, and blockchain immutability, the platform serves the entire ecosystem—from issuers proving impact to investors validating claims.

Why Choose ESG Credits

- ICMA framework foundation - built around established green bond principles while remaining flexible for multiple taxonomies

- Visual framework comparison - embedded charts and fact tables enable head-to-head ESG assessment for investors

- Blockchain verification - immutable on-chain records provide tamper-proof impact tracking and reporting

- Global scalability - multilingual and cross-currency support enables portfolio-wide reporting across regions

- Automated reporting - generates integrated ESG outcomes for advisors managing investments spanning currencies and taxonomies

Enterprise-Ready Reporting at Scale

These capabilities converge to enable global-ready, investor-focused ESG reporting at scale. Whether managing a single investment or a portfolio spanning multiple currencies, taxonomies, and regions, advisors can generate integrated ESG outcomes efficiently and consistently.

The platform's multilingual and cross-currency support accommodates the inherent complexity of international green finance. Reusable report templates accelerate production of standardized disclosures while maintaining the flexibility for project-specific customization when needed.

Explore the ESG Credits platform to see how blockchain-powered reporting transforms green finance workflows. With a calculated $60M total addressable market in yearly fees in Europe alone, the commercial opportunity for standardized ESG infrastructure is substantial—and growing as regulatory requirements tighten globally.