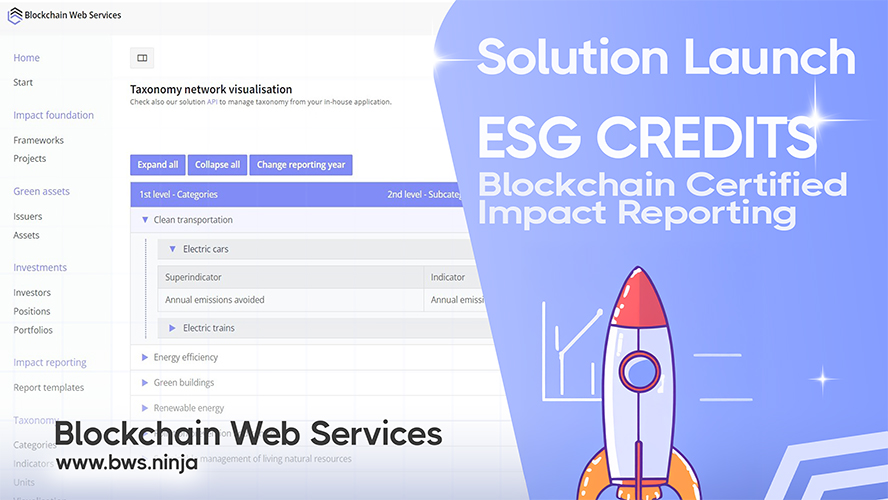

Automated Green Bond Framework Solution

The ESG Credits solution transforms how green bonds and sustainability projects are documented and reported. By automating impact alignment and standardizing ESG disclosures, the platform generates transparent, investor-grade reports directly on the BWS Marketplace.

This transformation is built on a solid foundation. The solution follows the ICMA (International Capital Market Association) framework, adhering to established structure, logic, and standards. Yet it remains flexible enough to work seamlessly across different taxonomies, ensuring compatibility with existing green finance practices.

For investors and analysts, the issuer marketplace changes the comparison game entirely. Using embedded charts and structured fact tables, users can visually assess green bond frameworks head-to-head. This enables rapid alignment with frameworks that match their specific investment criteria.

Global-Ready Portfolio Reporting

Scaling ESG reporting across borders introduces significant complexity—multiple currencies, varying taxonomies, and diverse regional requirements. The platform addresses these challenges head-on, enabling advisors to generate integrated ESG outcomes whether managing a single investment or an entire portfolio spanning multiple jurisdictions.

To support this global reach, the solution includes built-in multilingual and cross-currency capabilities. Furthermore, reusable report templates streamline the documentation process while maintaining the consistency and compliance that regulators demand.

Beyond reporting, the BWS.ESG API creates lasting proof of impact. Organizations can mint, track, and verify green actions with on-chain records, establishing an immutable audit trail for sustainability projects and carbon market activities that stands up to the most rigorous scrutiny.

Key Benefits and Advantages

ESG Credits brings much-needed transparency and standardization to green finance through blockchain-powered reporting and verification. The platform serves sustainability startups, NGOs, ESG fintechs, and corporate actors who are ready to move beyond claims into verifiable impact reporting.

Why Choose ESG Credits

- Automated impact alignment and standardized ESG disclosures

- ICMA framework compatibility with flexibility across taxonomies

- Visual comparison tools for green bond framework analysis

- Multilingual, cross-currency support for global portfolios

- Immutable blockchain records for verifiable sustainability tracking

Market Validation and Adoption

The ESG Credits solution is making its initial push into the European market, targeting a calculated €60M total addressable market in yearly fees. Early traction is promising—live demos are currently underway with strong inbound interest from ESG and corporate actors exploring blockchain-based sustainability reporting.

This interest comes from precisely the right audience. The platform is purpose-built for sustainability startups, NGOs, ESG fintech companies, and carbon markets that require transparent, verifiable impact documentation.

Ready to see how blockchain technology can transform your green finance reporting? Explore ESG Credits on the BWS Marketplace and discover how to build investor confidence in your sustainability projects with verifiable, immutable records.