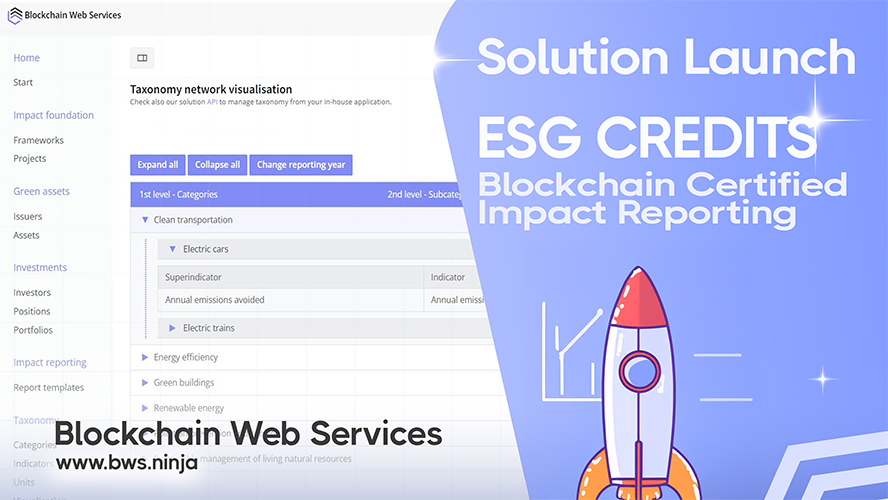

Automated Green Bond Framework Solution

ESG Credits transforms how green bonds are structured and reported. By automating impact alignment and standardizing ESG disclosures, the platform delivers the investor-grade transparency that sustainable finance demands.

At its core, the green bond framework solution enables organizations to certify sustainability projects and tokenize their environmental impact. Through the BWS.ESG API, organizations can mint impact credits, track green initiatives in real-time, and prove their sustainability claims with blockchain verification.

This solution is built around the ICMA framework, following its proven structure and logic without locking users into any specific taxonomy. As a result, organizations gain the flexibility to meet diverse ESG reporting requirements across jurisdictions and standards.

Visual Comparison and Portfolio Reporting

Beyond individual project tracking, the issuer marketplace empowers investors and advisors to make informed decisions at scale. Users can visually compare green bond frameworks side-by-side, assessing ESG characteristics through embedded charts and structured fact tables.

This comparative capability extends seamlessly into portfolio-scale reporting. Whether managing a single investment or a diverse portfolio spanning multiple currencies and regions, advisors can generate integrated ESG outcomes that tell the complete sustainability story.

Moreover, the platform's multilingual and cross-currency support ensures it works effortlessly for international portfolios. This global-ready approach means ESG reporting scales with your ambitions, not against them.

Key Benefits and Advantages

ESG Credits delivers frictionless green investing with automated compliance and transparent verification. The platform serves sustainability startups, NGOs, ESG fintechs, and carbon markets with capabilities that address the core challenges of sustainable finance:

Why Choose ESG Credits

- Automated impact alignment and standardized ESG disclosures for green bonds

- Blockchain-verified sustainability certifications with immutable proof

- Visual framework comparison with embedded charts and structured fact tables

- Portfolio-scale reporting with multilingual and cross-currency support

- Built on ICMA framework for flexibility across ESG taxonomies

Real-World ESG Traction

The market is responding. Live demos are underway with strong inbound interest from ESG leaders and corporate actors moving into blockchain-verified sustainability. The platform targets a European market with a calculated $60M total addressable market in yearly fees.

This traction reflects a broader shift in how green finance operates. ESG Credits redefines how sustainability is tracked, verified, and reported on-chain, meeting the growing demand for transparency and accountability in impact investing.

Organizations are already using the BWS.ESG API to mint impact credits, track sustainability projects, and generate investor-grade reports backed by blockchain verification. Discover how ESG Credits transforms sustainable finance with transparent, blockchain-powered impact reporting that makes green investing frictionless for organizations entering Web3.