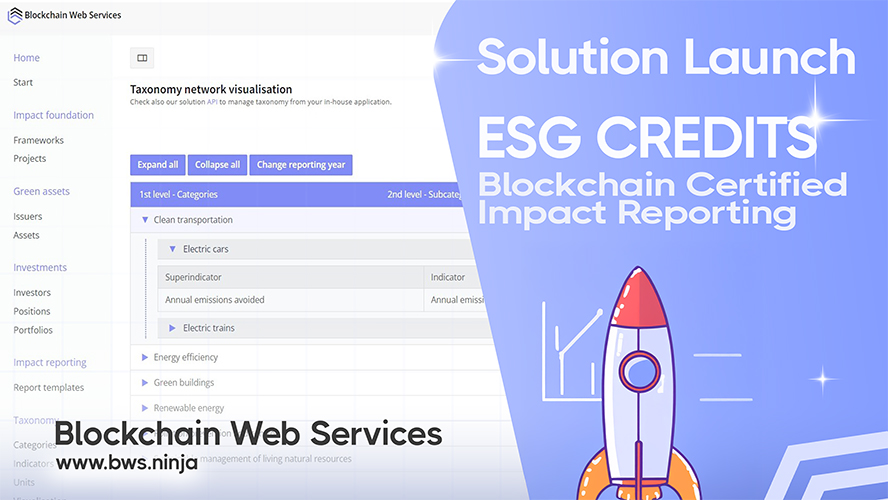

Green Finance Meets Blockchain

ESG Credits certifies sustainability impact and tokenizes green projects, bridging the gap between environmental action and verifiable proof. The BWS.ESG API enables organizations to mint, track, and prove environmental action with blockchain verification.

This solution specifically targets sustainability startups, NGOs, ESG fintechs, and carbon markets—sectors where transparency and trust are paramount. Live demos are currently underway, generating strong inbound interest from ESG and corporate actors exploring blockchain-backed reporting.

By combining these capabilities, the ESG Credits solution automates impact alignment and powers transparent reporting. The platform fundamentally redefines how green finance is tracked, verified, and reported on-chain.

Green Bond Framework Solution

Building on this foundation, the new green bond framework solution is now live on the BWS Marketplace. It automates impact alignment and standardizes ESG disclosures for investors and advisors seeking clarity in complex green finance markets.

The issuer marketplace lets users visually compare green bond frameworks side by side. Embedded charts and structured fact tables enable head-to-head ESG characteristic assessment, allowing users to align with frameworks that match their specific investment criteria.

Crucially, the platform is designed to be flexible and not tied to any specific taxonomy. It's built around the ICMA framework, following its structure, logic, and principles while remaining adaptable to evolving regulatory landscapes.

Portfolio-Scale ESG Reporting

Beyond individual bonds, the tool enables ESG reporting at scale with global-ready, investor-focused capabilities. Whether managing one investment or a portfolio spanning currencies, taxonomies, or regions, advisors can generate integrated ESG outcomes seamlessly.

Built with multilingual, cross-currency support and reusable report templates, the platform serves international investment needs from day one. As a result, advisors and analysts can assess and report ESG characteristics consistently across diverse holdings without manual reconciliation.

Ultimately, the solution delivers investor-grade reporting backed by blockchain verification. Explore ESG Credits to see how blockchain transforms green finance transparency and impact verification at scale.

Key Benefits and Advantages

ESG Credits brings measurable improvements to green finance reporting and verification. The platform serves sustainability organizations, investors, and advisors with scalable tools that address today's most pressing transparency challenges.

Why Choose ESG Credits

- Certify sustainability projects with blockchain-backed verification

- Automate ESG disclosure alignment with standardized frameworks

- Compare green bond frameworks visually with embedded analytics

- Generate portfolio-scale reports across currencies and taxonomies

- Target ESG fintechs, carbon markets, and sustainability startups

Market Focus and Adoption

The business team is targeting the European market initially, where regulatory pressure for ESG transparency is strongest. The calculated Total Addressable Market reaches 60 million dollars in yearly fees, representing significant growth potential.

This commercial focus is validated by strong inbound interest from ESG and corporate actors exploring blockchain-backed impact reporting. The platform positions itself strategically at the intersection of green finance and Web3 infrastructure—a space experiencing rapid convergence.

Meanwhile, live demos continue to demonstrate real-world applicability across use cases. The solution addresses genuine needs for transparency, standardization, and verifiable impact in sustainability finance as the industry matures.