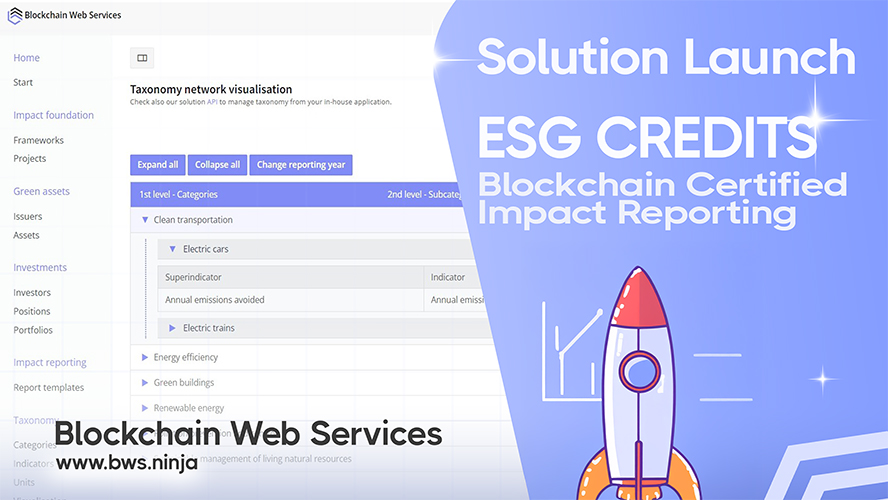

Green Bond Framework Solution

ESG Credits delivers a comprehensive green bond framework solution that automates impact alignment and standardizes ESG disclosures. The platform empowers sustainability startups, NGOs, ESG fintechs, and carbon markets to certify impact and tokenize sustainability projects with confidence.

At the heart of this solution is the BWS.ESG API, which allows organizations to mint, track, and prove green action through blockchain verification. This system follows ICMA framework structure, logic, and principles while remaining flexible enough to adapt to various taxonomies—giving organizations the standardization they need without sacrificing customization.

As a result, organizations generate transparent, investor-grade reporting that meets compliance requirements across jurisdictions. Live demos are currently underway with strong inbound interest from ESG and corporate actors moving into blockchain. Explore the BWS.ESG API documentation for integration details.

Issuer Marketplace and Comparison

Building on this foundation of standardized data, the issuer marketplace transforms how investors evaluate green bonds. The platform lets investors, advisors, and analysts visually compare green bond frameworks using embedded charts and structured fact tables, enabling head-to-head assessment of ESG characteristics.

This visual approach makes complex ESG data accessible and actionable for decision-makers. Rather than sifting through disparate documents, financial professionals can quickly evaluate multiple green bonds and identify investments that align with their sustainability goals.

The result? ESG clarity through comparison capabilities built directly into the platform. These tools dramatically reduce research time while improving decision quality—a critical advantage in today's fast-moving sustainable finance market.

Key Benefits and Advantages

ESG Credits transforms how organizations manage and report sustainability initiatives. By combining automation with blockchain verification, the platform delivers trusted, scalable impact reporting that meets the demands of modern green finance:

Why Choose ESG Credits

- Automated impact alignment and standardized ESG disclosures for green bonds and sustainability projects

- Blockchain-verified certification that provides immutable proof of environmental impact and compliance

- Visual comparison tools that enable investors to evaluate multiple green bond frameworks side-by-side

- Built on ICMA framework principles with flexibility to adapt to various taxonomies and reporting standards

- Global-ready with multilingual and cross-currency support for managing portfolios across regions

Portfolio-Scale ESG Reporting

These capabilities come together to enable true portfolio-scale ESG reporting. Advisors can generate integrated ESG outcomes whether managing one investment or a portfolio spanning multiple currencies, taxonomies, and regions.

Built with reusable report templates, the system scales seamlessly from individual bonds to complex multi-asset portfolios. Financial advisors produce consistent, investor-focused reports that meet regulatory requirements across jurisdictions—turning what was once a manual, time-intensive process into an automated workflow.

The platform initially targets the European market, with a calculated 60M TAM in yearly fees. Strong interest from institutional investors and corporate ESG teams validates this approach and signals growing demand for standardized, verifiable ESG reporting. See how ESG Credits simplifies compliance for your organization.