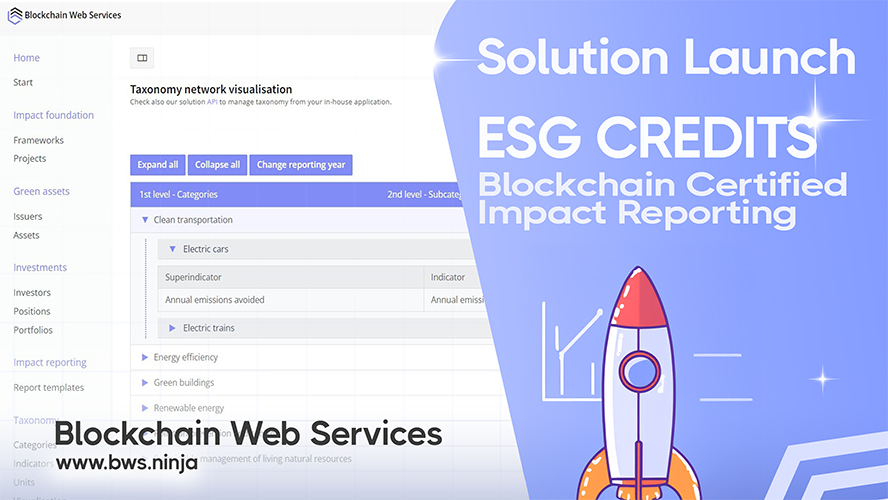

What Is ESG Credits

ESG Credits is a green bond framework solution that automates impact alignment, standardizes ESG disclosures, and powers transparent investor-grade reporting. By leveraging blockchain technology, the ESG Credits platform provides immutable certification of sustainability projects that investors can independently verify.

This verification capability allows organizations to certify impact and tokenize sustainability projects with confidence. Through the BWS.ESG API, users can mint, track, and prove green action with verifiable on-chain records that eliminate trust gaps in ESG reporting.

What sets the platform apart is its flexible, taxonomy-agnostic design. Rather than locking users into rigid classification systems, it follows ICMA framework structure, logic, and principles. This approach ensures compatibility with established green finance standards while maintaining the adaptability needed for evolving regulatory landscapes.

Core Features and Capabilities

Building on this foundation of verified transparency, the issuer marketplace delivers practical tools for investment decision-making. Investors, advisors, and analysts can visually compare green bond frameworks side-by-side using embedded charts and structured fact tables that surface ESG characteristics at a glance.

These transparent comparison tools enable users to quickly align with frameworks that match their specific investment criteria. Beyond comparison, the platform supports multilingual, cross-currency reporting and reusable report templates—essential capabilities for advisors managing portfolios spanning multiple regions and regulatory environments.

The solution scales seamlessly from single investments to complex portfolios. Whether tracking one green bond or generating integrated ESG outcomes across dozens of holdings, the platform delivers consistent, portfolio-wide visibility that advisors need to manage diverse sustainability-focused investment vehicles.

Key Benefits and Advantages

These capabilities translate into tangible operational and strategic advantages. ESG Credits transforms green finance workflows by eliminating manual reporting overhead and establishing trust through blockchain verification, giving organizations standardized, auditable impact reporting that meets investor expectations.

Why Choose ESG Credits

- Automated ESG disclosure eliminates manual reporting processes and reduces compliance costs

- Blockchain-backed immutability provides investor-grade verification and audit trails

- Visual framework comparison tools enable faster, more informed investment decisions

- Multilingual and cross-currency support accommodates global portfolio management

- ICMA framework alignment ensures compatibility with established green finance standards

Target Market and Adoption

With these benefits in mind, the platform targets sustainability startups, NGOs, ESG fintech companies, and carbon markets where transparency and verification create the most value. Live demos are currently underway, generating strong inbound interest from ESG actors and corporate entities moving into blockchain-based sustainability reporting.

BWS is strategically focusing on the European market first, where a calculated total addressable market of 60 million dollars in yearly fees awaits. This geographic focus capitalizes on Europe's leadership in sustainable finance regulation and its position as the world's largest green bond market.

Organizations ready to modernize their green finance infrastructure can explore ESG Credits capabilities through the BWS Marketplace. The solution is live and available now for green bond issuers, investors, and advisors seeking transparent, blockchain-verified impact reporting.