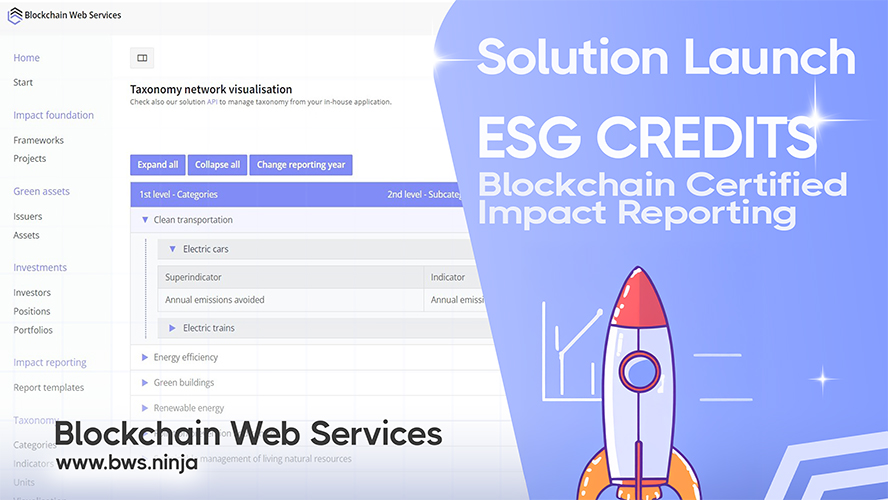

Frictionless Green Investing

The green bond framework solution eliminates traditional friction by automating impact alignment and standardizing ESG disclosures. This automation powers transparent, investor-grade reporting underpinned by immutable blockchain verification.

Built for flexibility, the ESG Credits platform isn't tied to any specific taxonomy. Instead, it's structured around the ICMA framework, following its established logic and standards while remaining adaptable to various requirements.

Through the BWS.ESG API, users can mint, track, and prove green action with verifiable precision. Organizations leverage this capability to certify impact and tokenize sustainability projects, creating permanent on-chain records that stand up to scrutiny.

Issuer Marketplace and Comparison

Beyond individual project tracking, the issuer marketplace empowers investors, advisors, and analysts to visually compare green bond frameworks side-by-side. Embedded charts and structured fact tables enable direct assessment of ESG characteristics across multiple issuers.

This comparative capability enables precise alignment with frameworks that match specific investment criteria. Rather than reviewing frameworks in isolation, users gain ESG clarity through direct comparison tools that highlight differences and strengths.

As a result, investors can evaluate multiple frameworks simultaneously and make informed decisions based on standardized data presentation. The visual comparison tools transform complex ESG assessment processes into straightforward, actionable insights.

Global-Ready Reporting

With comparative analysis in place, the platform scales to meet global reporting demands with investor-focused precision. Whether managing a single investment or a portfolio spanning multiple currencies, taxonomies, and regions, the tool delivers consistent results.

Advisors particularly benefit from the ability to generate integrated ESG outcomes across diverse portfolios. Multilingual and cross-currency support comes built-in, eliminating the need for manual translation or conversion.

Furthermore, reusable report templates streamline ongoing reporting requirements for maximum efficiency. Organizations save substantial time while maintaining consistent, professional ESG documentation across all investments—from initial certification through ongoing impact reporting.

Key Benefits and Advantages

Together, these capabilities transform how organizations approach green finance tracking and reporting. ESG Credits delivers blockchain verification and automated workflows purpose-built for sustainability startups, NGOs, ESG fintechs, and carbon markets.

Why Choose ESG Credits

- Automated impact alignment and standardized ESG disclosures reduce manual reporting overhead

- Immutable blockchain verification provides transparent, auditable proof of green action

- Visual framework comparison tools with embedded charts and structured fact tables

- Global-ready with multilingual, cross-currency support for diverse investment portfolios

- Built around ICMA framework while remaining flexible for various taxonomies and standards

Market Targeting and Adoption

These benefits address urgent market needs across sustainability startups, NGOs, ESG fintechs, and carbon markets. Live demos are currently underway, generating strong inbound interest from ESG leaders and corporate sustainability teams.

Initially targeting the European market, the platform addresses a calculated 60M+ TAM in yearly fees. Organizations across the region are actively moving into blockchain-verified sustainability tracking to meet regulatory requirements and investor demands.

Explore ESG Credits and discover how it enables your organization to certify impact, tokenize sustainability projects, and generate investor-grade reports that build stakeholder confidence.